The Dutch economy is going strong, and ABN AMRO’s Economic Office forecasts growth of almost 2.5% for 2017. This sharp increase is primarily due to exports, personal consumption and business investments. Thanks to the rise in economic activity, the number of jobs is growing faster than in 2016 too.

The study analysed the figures over the past three months and the past twelve months – three months to show the short-term development and twelve months to demonstrate the long-term trend. The number of bankruptcies among companies and institutions peaked in 2013, when 9,431 organisations went into liquidation. Now, 3.5 years later, that figure is 58% lower. In the 2004-2008 period, an average of 4,400 companies and institutions went bankrupt per year.

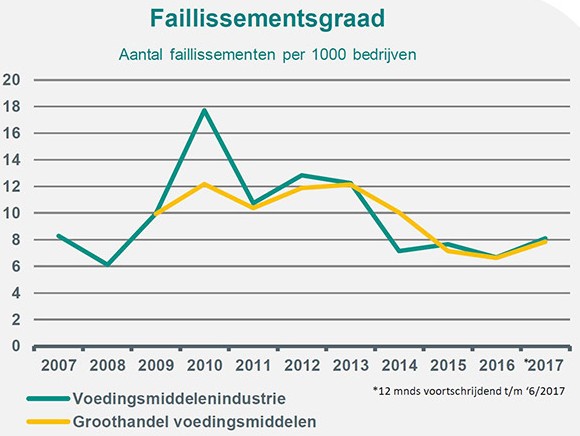

The bankruptcy level varies significantly from one sector to the next, largely depending on the number of one-person companies. The manufacturing and transport & logistics industries have always had a high bankruptcy level and that continues to be the case, whereas the figure has always been low in agriculture. In the first half of 2017 the number of bankruptcies fell by 22% compared with the first half of 2016.

In the car retail , food service, and technology, media & telecom (TMT) sectors there was a small rise in the first half of this year compared with the same period in 2016. However, these increases were only minor, so these sectors can be regarded as stabilising.

There has been a notable increase (+49%) in the number of bankruptcies in the food sector. This appears to be a substantial rise, but in the case of relatively small numbers an overall increase soon produces high percentages. For example, the number in the first half of 2017 was still 55% below the peak of 2013.

Two fundamental causes of the high bankruptcy rate can be identified as follows:

the sector has a high number of bankruptcies with respect to the total number of closures across the board, and

there are fewer one-person companies in the food sector than in many other sectors. One-person companies are less likely to go bankrupt and this has an impact on the bankruptcy level.

The sustained economic growth in 2017 and 2018 will continue to be reflected in the bankruptcy trend. ABN AMRO expects that the number of bankruptcies – in terms of the cross-sector average – will stabilise around the current low level or fall slightly over the coming year. There will be visible differences between the sectors, however. The number of bankruptcies will play an ever-smaller part in the dynamics of setting up and closing down companies. This is due to the strong growth in the number of one-person companies. As mentioned, these companies are less capital-intensive. Their bankruptcy rate is much lower because they can cease trading without having to file for bankruptcy. ABN AMRO expects this trend to continue.

There are two factors of uncertainty that could affect the development of the bankruptcy level in the years ahead, as follows:

The first is Brexit. On 19 July ABN AMRO Sector Advisory published a report examining the influence of a Brexit on specific sectors of the Dutch economy. The report concludes that it would have a relatively substantial effect on Dutch businesses. For companies with a relatively high exposure to the UK, the financial risks will increase.

ABN AMRO’s Economic Office expects that the ECB will start to gradually reduce its bond purchases in early 2018, with a view to terminating the purchase programme in June 2018. As a result, the interest rate will slowly begin to rise again. For companies with a relatively weak financial position, this will make (re)financing considerably more expensive and there is a good chance that this could cause problems for some of them.

Sources: CBS, ABN AMRO Economic Office, Sector Advisory

Source: © Pixabay